Best Trading Platforms In Canada

Best Trading Platforms In Canada

One of the massive issues for most new traders is that they overtrade. When you day trade you might be simply sitting there and the price is continually transferring.

What Is A Trading Platform?

Futures are extra regulated, and there are minimum margin necessities, but they are much lower than with stocks. Controlling a single S&P 500 Emini (ES) contract solely requires a balance of $400 with some brokers, and normally a minimal deposit of $1000, though starting with far more than that is really helpful. To correctly manage threat on a popular contract like ES, starting with a minimum of $8,000 is preferred. The margin necessities of futures contracts differ, so this really helpful beginning steadiness might be smaller to larger depending on the contract being traded.

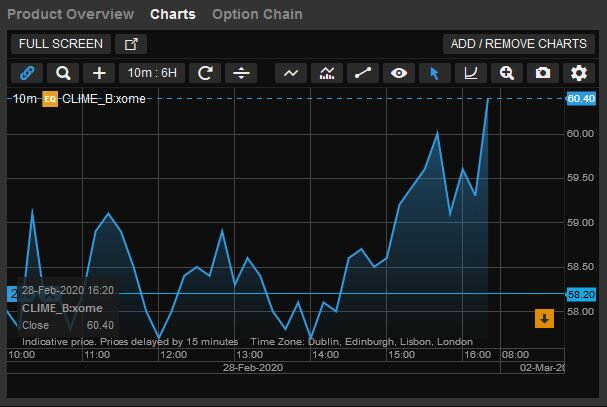

UFX are forex trading specialists but additionally have a number of popular stocks and commodities. Offering tight spreads and probably the xcritical greatest ranges of main and minor pairs on supply, they are an excellent possibility for forex traders.

Best Brokers For Day Trading

Do you need 25k to day trade?

Anyone who makes 4 or more day trades in a 5 day period is required to have at least $25,000 in their trading account, and if they don’t they won’t be able to make anymore margined day trades until they bring their balance up to $25,000. You can day trade as much as you want if you aren’t using margin.

Day buying and selling forex or futures requires much less capital, and you’ll even day commerce stocks with less than $25K if you understand the loopholes or team up with a day buying and selling firm. The Canadian department of Interactive Brokers, the Greenwich, Connecticut based mostly low cost brokerage agency was based by Hungarian-born billionaire Thomas Peterffy. One of the earliest online brokerages, Interactive Brokers has lengthy been favoured by lively merchants owing to its low trading costs. The brokerage arm of the big hundred-yr-old Quebec monetary cooperative was founded in 1991, and offers buying and selling platforms for each occasional and energetic traders.

Interactive Brokers Vs. E*trade

Roll back the dice a number of years and you needed a minimal of $25,000 to start day buying and selling in the US. Not solely that, but you all the time had to keep at least that amount in your account. Whereas, day buying and selling shares for a living may be tougher.

- This app allows customers to trade a variety of investments, including stocks, options, foreign forex and futures.

- Mobile Trader is customizable, in that you can generate charts, monitor trends and simulate more complex trading choices, based mostly on your threat tolerance, targets and general investing strategy.

Ultimately it comes all the way down to controlling risk, which determines place dimension, which in flip lets us know what our account stability should be in order to take a trade. There are a few hiccups with the money account day trading approach. With a money account, you https://xcritical.com/ can’t brief shares, and choices methods may even be restricted to purchasing puts/calls and promoting covered options. For instance, in case you have $10,000 you’ll be able to open a cash trading account (not a margin account) and simply commerce your $10,000.

In addition, a comparatively high quantity of initial capital is required and losses could be more financially devastating. Day trading refers to opening and closing the identical stock positions throughout one trading day. In practice, many day traders hold stocks for minutes, or even seconds, at a time. If you already have a checking account with SBI, go ahead and open a Demat account with them. It is easy and makes stock market funding and buying and selling very straightforward.

In a research paper printed in 2014 titled “Do Day Traders Rationally Learn About Their Ability? Again, as a new trader, it’s straightforward to get addicted to the concept trading platform software that you’ll find out how markets work, make some sharp trades that other investors missed, and earn 1000′s in a couple of days.

SBI demat account advantages include its attain to rural areas, strong research and advisory, on-line buying and selling platform, a variety of investment options and native customer support. Before diving into the world of day trading, be clear about your danger tolerance and aims. Decide what sort of securities you’re most comfy investing in and consider your financial place to determine how much cash you need to invest regularly. Also contemplate how day trading fits inside your broader asset allocation strategy.

If you have less than $25K, your subsequent finest options are to day trade forex or futures. These markets require much less capital and are also great day buying and selling markets.

TV is another way to expose your self to the stock market. Even turning on CNBC for 15 minutes a day will broaden your knowledge base.

So even when you can solely find a number of stocks with good motion and quantity on that exact trade, that may be sufficient. One isn’t higher than one other, it’s simply desire and which one suits your life. To day commerce shares within the US requires sustaining a balance of $25,000 within the day buying and selling account.

Depending on the frequency in which they transact and the technique driving their actions, they’re either “merchants” (think Gordon Gekko in the film “Wall Street”) or “investors” (as in Warren Buffett). Do swing buying and selling and enter trades that you simply hold for longer than at some point. Swing traders seize trends that play out over days or weeks quite than attempt to time a one-day trend that https://dreamlinetrading.com/ may final for 20 minutes. While this is much less a loophole and more of a change in technique, it works for merchants who need to keep actively concerned but do not but have enough equity to satisfy the $25,000 requirement for day buying and selling. Failing to give it this sought of respect is a serious cause why most merchants fail to make money when buying and selling the stock market.

This fee is handed onto prospects by banks and brokerage corporations. The three-in-1 account is the set of 3 accounts which are linked collectively for seamless transactions between them.